Capital Facilities Tax funding helps to keep our key infrastructure (water, sewer, roads, etc.) in good condition. This may include replacing aging water mains, upgrading sewer mains to accommodate growth, or simply keeping county roads in passable and safe condition given the toll taken by Wyoming’s weather.

If the Capital Facilities Tax is not renewed, infrastructure improvements may be delayed or not completed in a timely manner. Without the Capital Facilities Tax, many of these projects would still need to be completed, but would have to be paid through other means.

The Capital Facilities Tax renewal amount has varied over the years (e.g., $25 million in 2009, $35 million in 2003 and $40 million in 2013) and is determined based on needed infrastructure projects identified in the long-term capital improvement plans of the County and municipalities.

The 2020 proposed renewal is $40 million to continue the long-range planning. The County and municipalities have identified infrastructure projects both in the near-term and longer-term (out through about 8 years) that are eligible for Capital Facilities Tax funds, and then used the estimated cost of these projects in developing the $40 million total. Long-range planning allows the entities more time to identify other funding sources and grant matches for specific projects to better leverage Capital Facilities Tax funding.

Between FY2006 and FY 2013, Sheridan County used Capital Facilities Tax funds to leverage an additional $10.7 million in grants for infrastructure projects. This means that for every dollar of Capital Facilities Tax funds used for infrastructure projects, the County was able to get an additional $0.62. Put another way, by using the Capital Facilities Tax funds on grant projects, the County multiplied funding on those projects by an additional 62%.

Between FY2006 and FY2012, the City of Sheridan leveraged Capital Facilities Tax funds to secure an additional $13.9 million in grants and other funding. This translates to an extra $0.70 for every Capital Facilities Tax dollar used — a multiplier on Capital Facilities Tax Revenue of 70% on City of Sheridan projects.

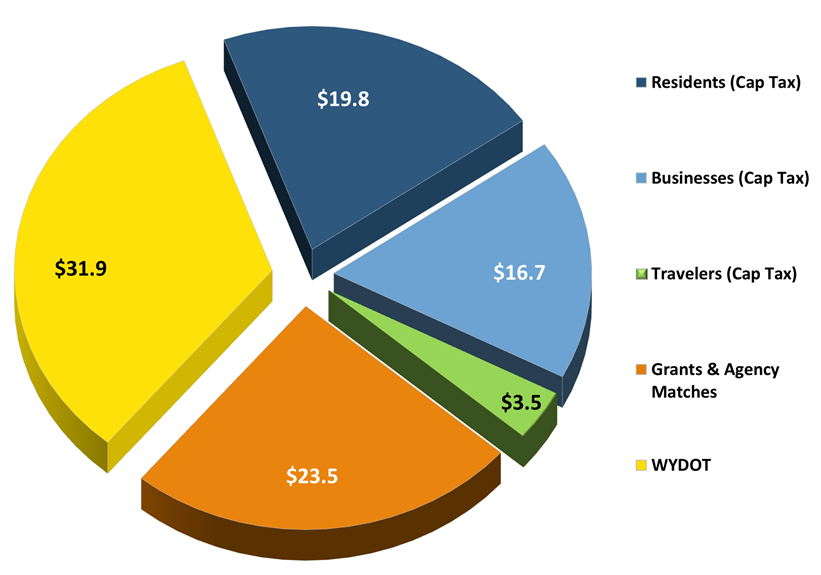

Based on previous years’ history, grants and agency matches for county-wide infrastructure projects proposed for funding under the 2014 Capital Facilities Tax are projected at $23.5 million.

100% of the optional Capital Facilities Tax revenue goes directly to the county and municipalities.

All purchasers of products and services in Sheridan County pay the Capital Facilities sales tax. The Capital Facilities Tax applies only to items that are subject to sales and use tax. The Capital Facilities Tax does NOT apply to sales of most foods for domestic home consumption (groceries), rental payments, home purchases or gasoline purchases.

Temporary employees in our communities, including those working in the construction and mineral development industries, are subject to the Capital Facilities Tax. Out-of-county visitors and tourists also pay this tax on qualifying purchases.

The Sheridan County One Percent Specific Purpose Capital Facilities Tax (Capital Facilities Tax or Cap Tax) is an optional one-penny sales tax approved by Sheridan County voters. The Capital Facilities Tax is approved for a specific amount, exclusively for capital improvements to community infrastructure. Once the specified amount is raised, the tax automatically expires unless voters choose to renew the tax for additional infrastructure projects. From 1989-2020, Sheridan County voters have consistently voted to renew this tax. In that time, the tax has generated over $142 million for community infrastructure.

The Capital Facilities Tax renewal proposition on the November 3, 2020 ballot is for a maximum of $40 million to be raised over an estimated 8 years.